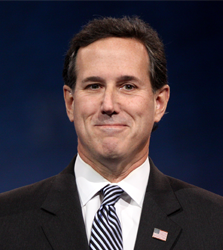

Santorum Proposes 20 Percent Flat Tax

Over the weekend former Pennsylvania Sen. Rick Santorum took to the pages of the Wall Street Journal to preview his tax reform plan, which is centered on a 20 percent flat tax for individuals and corporations:

A Flat Tax Is the Best Path to Prosperity

Since 2007, 15,000 American factories have shut down and more than two million manufacturing jobs have been lost. Wages have flatlined; American families are struggling.

In every recovery since 1960, real GDP grew by 4% a year, according to a report from the Congressional Joint Economic Committee. The Obama-Biden policies have resulted in a paltry 2.3% annual growth since the recession ended in 2009. This growth gap has cost the country $5.4 trillion in lost economic output and 5.5 million fewer jobs than would have been expected during a normal recovery.

So what is Hillary Clinton’s vision to get the economy moving? She wants to slam investors with higher capital gains taxes. Bernie Sanders wants to raise the top personal-income tax rate to 90%.

Donald Trump’s plan to make America great again? He’s offering a complicated tax cut that the Tax Foundation reports will explode the deficit by more than $10 trillion over a decade. Are any Republicans offering serious, specific proposals to scrap the toxic tax code? Jeb Bush wants three rates. Marco Rubio wants two. Rand Paul has proposed a single rate and creating a European-style value-added tax.

America deserves better. That’s why, in my first 100 days as president, I will submit to Congress a comprehensive Economic Freedom Agenda that will abolish the existing tax code. Under “The 20/20 Flat Tax: A Clear Vision For America,” individuals will pay a simple, low 20% individual rate that will be applied to all streams of income. It eliminates the marriage penalty, death tax and alternative minimum tax. It will treat every American the same. No longer will savings and investment be penalized.

Read the full article here (subscription may be required), or read the details of his "Economic Freedom Agenda" on his campaign's Web site.