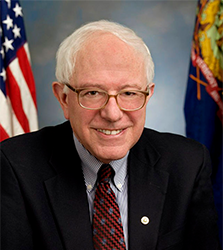

Sanders Demands Wall Street Change Its Ways

Vermont Sen. Bernie Sanders expanded on his proposed Wall Street reforms in a speech yesterday, as reported by Politico:

Sanders thrusts Wall Street reform to center of Clinton showdown

Pledging to identify the “too big to fail” banks and insurance companies within his first 100 days in the White House, and to break them up within a year, the Vermont senator fleshed out his long-anticipated Wall Street plan after months of sparring with Clinton and insisting the former New York senator is too close to the banks, pointing to her high level of support from the financial industry.

“Here is a New Year’s Resolution that we will keep, and that is: If Wall Street does not end its greed, we will end it for them,” Sanders said, also promising to prosecute Wall Street executives, to tax speculators, and to reinstate a version of the Glass-Steagall Act that creates a firewall between commercial and investment banking.

The full article includes more details, and the complete Sanders plan is available on his campaign web site here.